Index funds have a long history but have grown in popularity over the past few decades by offering low-cost exposure to financial markets and a consistent investment style. As passive strategies, they mirror benchmark indexes. Index fund shareholders do not pay management fees to portfolio managers for researching securities, selecting a portfolio, and seeking to manage risk.

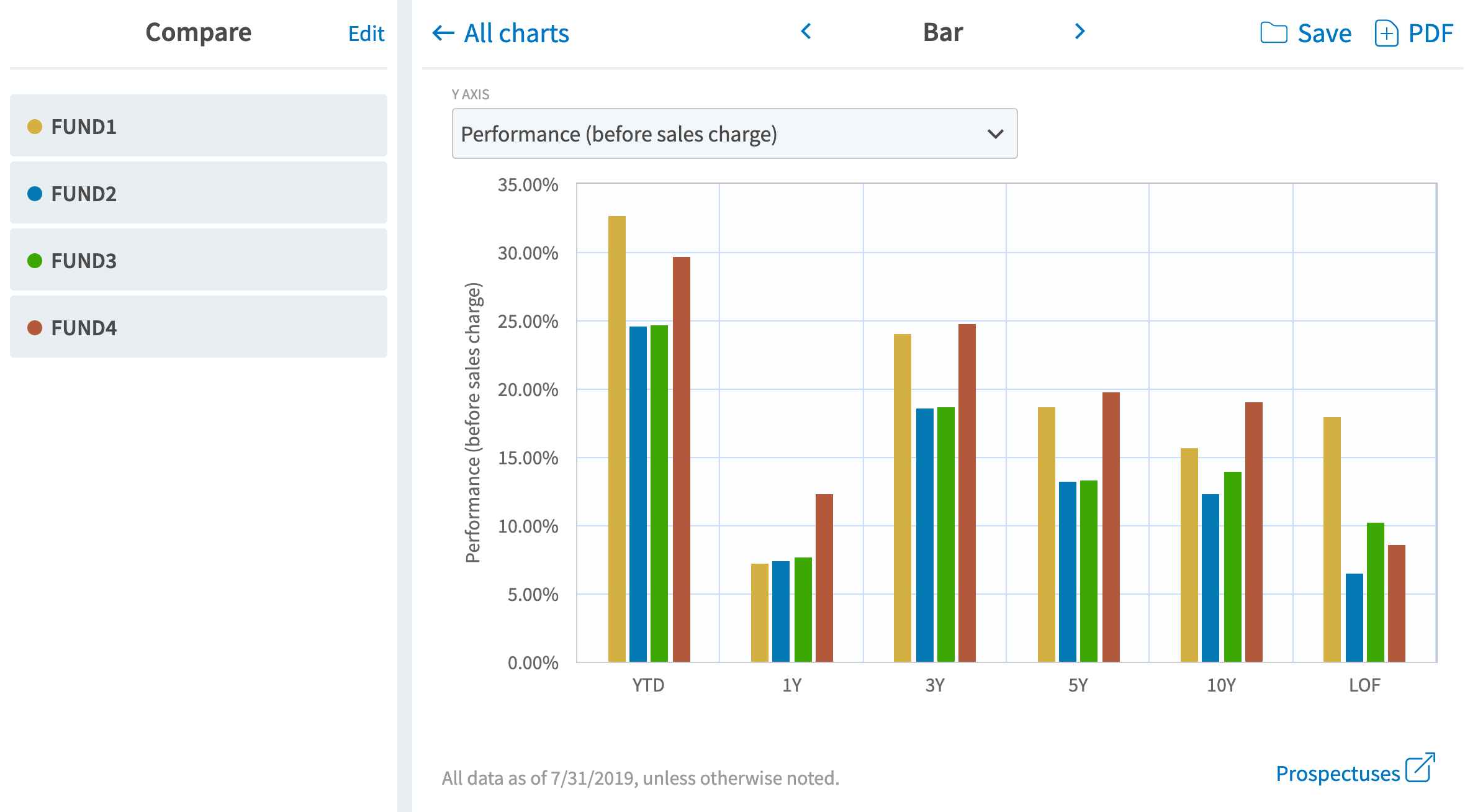

Compare funds to determine the most competitive expenses

Funds that track the same index should be similar, but they might not be exactly alike. FundVisualizer allows you to compare index funds and determine which offer the most competitive expenses.

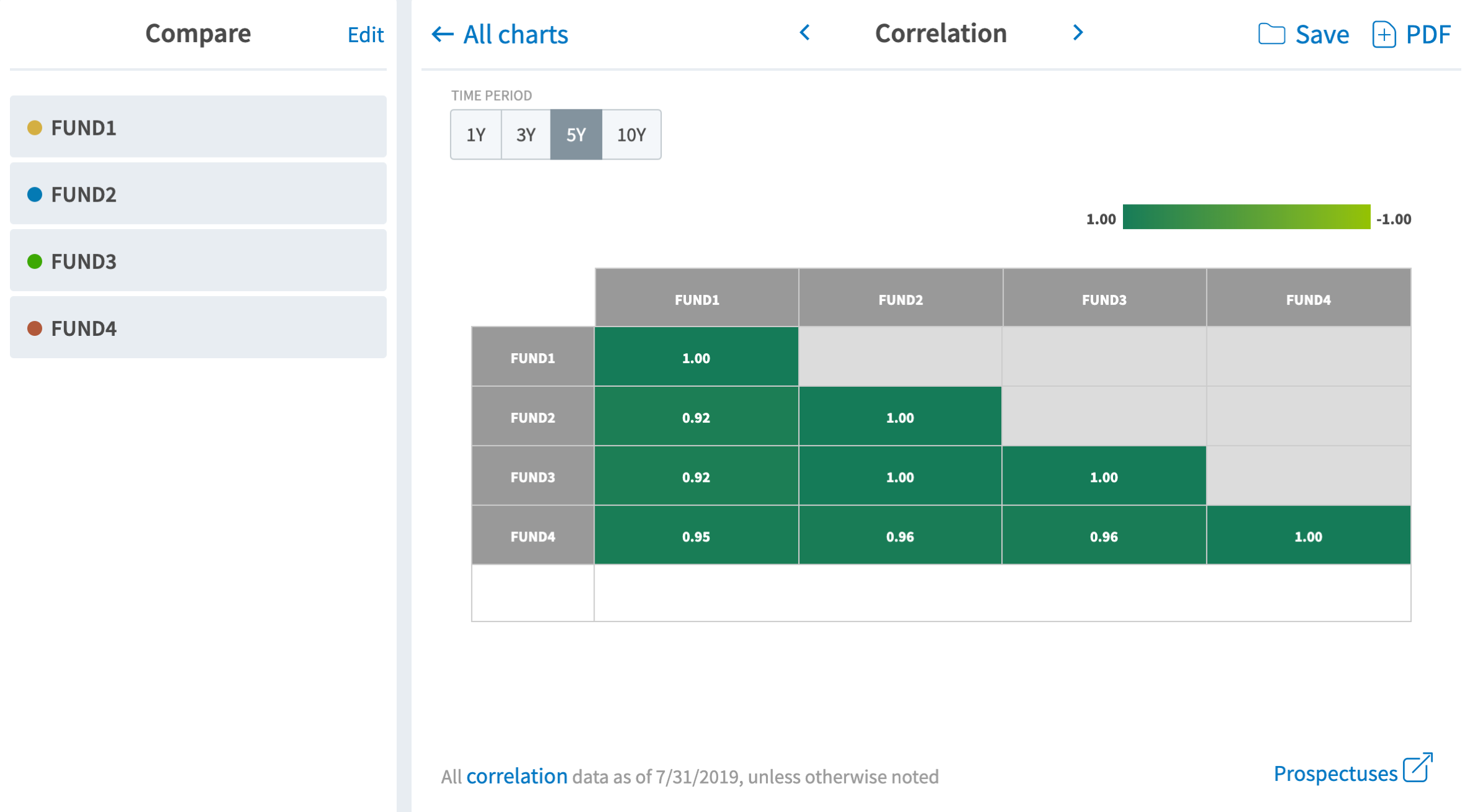

Compare index funds in correlation charts

FundVisualizer can also help you educate clients about portfolio diversification. If you are building a portfolio of index funds, use FundVisualizer charts to compare indexes and help demonstrate that stock index funds and bond index funds have low correlation to one other. FundVisualizer allows you to print and share your results with clients.